- No categories

-

- My Account Subscribe Now | Sign In Log Out

- New York, July 15, 2025

There is also something to be said about talking to people face-to-face. And maybe you will have a chance encounter that could not happen online.

Insight into the dynamics of this relationship comes courtesy of a new social listening study called “Luxury Brand CSR Perception Analysis: A Consumer Voice Snapshot.”

A more democratic-minded strategy will increase sales this summer and beyond.

The same underlying tech that powers cryptocurrencies such as Bitcoin is currently being adapted to all aspects of the fashion system from design to production to sale.

Pioneering companies are using millions of data points, from their keystrokes to how they physically interact with their smartphones, to build “behavioral biometrics” profiles of their customers.

Quality content is one of the highest ROI marketing investments you can make.

It is one of the most beloved parts of luxury shopping: the well-curated and often elegant in-store experience.

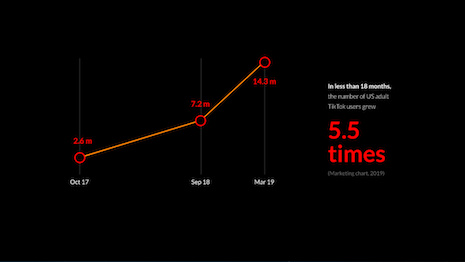

To use TikTok to its full potential as an influencer marketing tool, make sure you are following these three rules.

Consumers are increasingly aware that ads contribute to their ability to access apps and Web sites for free. They just may not have been privy to the number of details that were being obtained to make this happen.

While the Internet is convenient and socially distant, it does not afford consumers with what traditional shopping provides – socialization, instant gratification, tactile pleasure, true color and fit certainty.

Customers can do everything from the comfort of home. It just takes a kernel of creativity from brands to leverage technology into an improved customer experience.

Market researchers have failed to innovate any radically disruptive breakthrough to dramatically advance their understanding of consumers to support more effective brand marketing decisions.

More than 1 billion fashion products had been ordered via the online giant last year – and that is before taking into account any parallel categories such as cosmetics.

The pandemic has accelerated the movement toward globalism and collaboration between governments and the private sector. More and more the wealthy see themselves as global partners – citizens of the world.

To find signposts to the future, look to the traveler: the demand side of the equation.

Beyond the prestige of international tournaments, luxury brands compete to sign the biggest names or artists to win over the “fan fashionista.”

Luxury brands set themselves apart by the sophisticated way in which they analyze customer data and apply its insights to elevate both their digital and human interactions with their clients, stoking the emotional connections that are essential for building brand loyalty.

In today’s world, the entire business cycle is intercepted by digital interventions.

The new generation of marketers in fashion ecommerce has an irresistible urge – especially with pure ecommerce players – to equate marketing with digital marketing.

To better understand consumer behavior this past holiday season, we took a deep dive into anonymized customer and sales data based on more than 115 million online consumer visits to luxury retailers’ online stores in December 2020.

Trade secrets are one of the big four recognized forms of intellectual property. Yet many fashion and luxury goods companies neglect this protection.