- No categories

-

- My Account Subscribe Now | Sign In Log Out

- New York, July 15, 2025

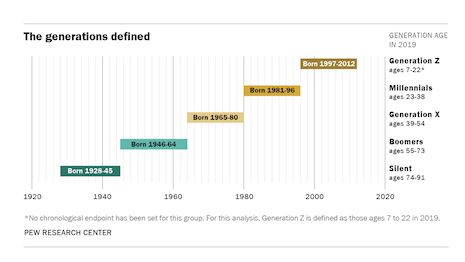

Gen Z is the youngest, most ethnically diverse and largest generation in American history. They make up 27 percent of our population.

Luxury businesses need to find ways to offer the same personalized experience found in physical stores, while catering to the growing demand for digital shopping options.

How can trademark law be used to control to whom and where luxury and fashion branded products are sold?

Early shoppers, a shortage of repair pros, in-store returns and logistical costs all loom.

With an absolute number of 56.1 million millionaires in a total population of 7.9 billion, the accumulation of wealth has never been higher.

Authentic goods, too, can turn into counterfeits as a matter of law, depending on how extensively they are altered.

The term “luxury” has always been difficult to define, especially as its essence is always changing.

Outside of traditional IP rights there are few paths that the originators of creative expressions can take to prevent the theft of their intellectual property, leaving them practically defenseless when confronted with such misuse.

For better or worse, scarcity and exclusivity are founding values of the luxury goods industry — values that have made most luxury brands extremely slow to adapt to digital world in which things are easily replicated.

While many industries were able to adapt and embrace the new digital frontier, for others, finding a substitution for in-person experiences was more difficult.

Luxury brands are currently signing more short-term leases in newer or unfamiliar markets.

The Chinese video-sharing platform was the only app not owned by Facebook to make the global list of top five downloads, taking the leading spot for the first time over Facebook.

According to the new U.S. Labor Department stats, inflation pushed up to 5 percent for the 12 months ended May 31 – a 13-year high. For many marketers who have spent the past 18 months riding a stomach-turning economic roller coaster, this news may seem hard to understand.

When it comes to the audio-first era that is upon us, luxury brands are mostly silent.

One particularly insidious issue that has entrapped numerous social media users is the posting of photos of themselves or their products to which they do not own the rights to, resulting in legal actions for copyright infringement.

Luxury Daily is inviting opinion pieces on luxury business, advertising, marketing, media and retail issues that affect marketers as they run multichannel programs for branding as well as customer acquisition, retention and reactivation.

For some of us, negative comments toward past work are etched into our minds and influence all of our work moving forward.

Luxury Daily is inviting opinion pieces on luxury business, advertising, marketing, media and retail issues that affect marketers as they run multichannel programs for branding as well as customer acquisition, retention and reactivation.

More than $2.5 trillion in savings was accrued over the pandemic. Moreover, the wealthiest 10 percent of Americans added more than $8 trillion to their net worth.

The marketing and sales funnel has dramatically changed, especially since COVID-19 hit.

Thanks to the release of Apple’s latest operating system, iOS14.5, apps will have to ask users to opt in for tracking. While it is early, one analysis found that only about 4 percent or 5 percent of Apple users are opting in so far.