With dealership service centers facing ongoing challenges due to a confluence of factors, elevated customer care needs to be a priority for luxury automakers.

According to the 2022 U.S. Customer Service Index (CSI) study from J.D. Power, drivers are needing service more often as they hold onto their vehicles longer, while also having to wait longer for service appointments. Overall satisfaction, however, ticked up as J.D. Power accounted for emerging offerings such as valet service, remote vehicle servicing and online/smartphone app payment options.

“Dealer service departments are in a pivotal position to improve customer satisfaction and provide greater customer convenience, even though many challenges – including the parts supply chain disruption and the availability of new-vehicle loaners – are out of their control,” said Chris Sutton, vice president of automotive retail at J.D. Power, in a statement.

“Proactive communication with customers is one solution for dealerships to mitigate a disruptively tough situation,” he said. “Simply implementing text or email alerts can greatly improve customer satisfaction.

“Additionally, letting customers know what is happening at each step along the way, including why it is taking longer to book an appointment or providing any updates in parts delays, can help improve satisfaction.”

The 2022 report is based on a survey more than 67,000 verified registered owners and lessees of 2019 to 2021 model-year vehicles. Overall customer service satisfaction is scored on a 1,000-point scale.

Service meets tech

For drivers, the most important attribute of a trustworthy dealership is being able to perform complex vehicle repairs. This is followed by taking responsibility for and resolving any mistakes.

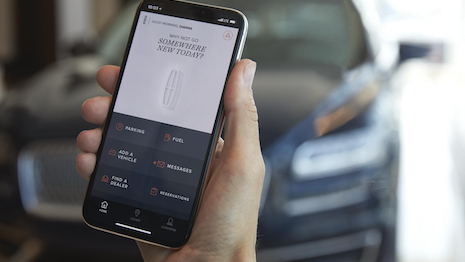

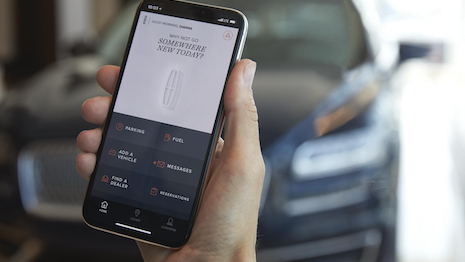

Drivers also tend to have more satisfactory experiences with service centers that leverage technology.

Lincoln is encouraging use of its mobile app for service visits. Image courtesy of Lincoln

Lincoln is encouraging use of its mobile app for service visits. Image courtesy of Lincoln

More than 40 percent of respondents prefer receiving text messages with appointment reminders or status updates for in-process service. Dealerships that provide photo or videos are also perceived to be more trustworthy than those that do not.

Dealerships are increasingly turning to valet services – in which the dealership picks up the vehicle – or mobile services – when dealerships send technicians to a driver’s location. Customer satisfaction for these services is 866, compared to 847 for in-person service visits.

Among premium brands, the average satisfaction score was 866. Mass market automakers trailed with an average score of 844, with British marque Mini leading the segment with a score of 873.

Accounting for both the premium and mass market segments, overall customer service satisfaction was 848 – up from 847 last year.

Toyota Corp.’s Lexus led all automakers with a score of 897. U.S. automaker Cadillac edged out Germany’s Porsche, the 2021 winner (see story), 880 to 879, respectively.

Lounge area at a redesigned Porsche dealership. Image credit: Porsche

Lounge area at a redesigned Porsche dealership. Image credit: Porsche

Among the other German marques, BMW tied the segment average with a score of 866, followed by Audi’s 865. Mercedes-Benz scored 849, still above the overall average.

U.S. automaker Lincoln scored 854, while British automaker Jaguar performed better than its sister brand Land Rover, 858 to 815.

EV service

J.D. Power also noted that electric vehicle owners still trail drivers of gas- or diesel-powered vehicles in customer satisfaction by a significant margin.

This should be a priority as more luxury automakers turn to electrification.

EV services can even extend to educational efforts, as many consumers’ online experiences are leading to purchases.

According to research from media platform Teads, 52 percent of first-time electric vehicle buyers believe the importance of brand websites increased during the pandemic. There is still room for automotive brands to expand their online presence and to educate consumers on what they must know before purchasing a vehicle (see story).

“BEV service is the next frontier for dealerships,” Mr. Sutton said. “The automotive industry has to get ready now and get the service experience right with BEV owners or they risk losing them to aftermarket service providers.

“This includes fully understanding BEV customer pain points like range anxiety, unique maintenance requirements and support for related services such as availability of charging stations.”

{"ct":"k98nyUh5gnIcZymDs0oGq\/4Gwsc05+jU7Aeals01nxj0+1nCSrnvOWoV8EH016QWFD6NzkApm2SCSdhQKVGS5BlVlkX0yWATlbvPR+LR3AkFmhIY4ICf0ppu4W0EpLU1WEcRJ6DCMJW+tEEMFn6NU1ljrEn2zfi9x2ew\/IsVU4ydS4w0B1AEFFvjiQBi0q1+5FZ0yMlHF9UrT1Vpd974AMtZ9mHzgsfZFhDCYGLyURS4VIEH7ASY5hTv2BpXI3tvvnTRwmGxnzrk\/9QBOiQ+IX9vepmsH6xzClV7NYbRkHYZXZ7ZUkD4r2bM5qRF\/OvvEiK7ZsZDTGAyiZ5OGSYcG5L47zBGL\/EYMamJEjI+idyM5982JyAm9GO7jCOBqMdrIl\/9QNRFikTqDthw7w4qRADrGSD1biuiqmISTwHyRUfzKgKl9xxBM9CadlrVk185\/0RIjra8Bx9vXYLMF7F1VS\/u19gyv7cnVkPSHMyhNZPT2jxGtvmNZj1AcwwOltt1jQ3sxo\/Cbvq7hS6As\/+FTSIpWwnXUxjd0+fPFGQrG0Woa7rsthVGgk3cOqB6+4\/17Ry6QySsg4uIkor+FLafS\/gp9WmEUm58Xjcu\/nSnvIl8y6\/68mrkrOItbEzzCio12dyXkonU7GKe13mhlyfwgZ1mSpODJEbvvJKnopCeMRXcUFju\/FCgjWzd\/uc7RKGB3rXkaCeAVvV21Kx2ZwEkGJpulzWit4Az\/dRaUHDjXM3\/IoOxawqjhMMVfibE1PAb6MSolsYVTmQnbu0cJ7IC8okfFCdBgS\/woZjhZqlMwxxKL8ItPpXHeotpu5NBV6C\/+Sx6YluVoqVRJTCFObkvSVhjouzU6V4b6C3DsTIkQCAWWsxHW1iGI5ajCetSmwJMelIjx8R9xL+mVo7oOwXJP3NWS4\/IG7FU1EDu8Pv143Scbe2rHcETSJrI0JwWDn3kzAYBTFaf1\/Y1+ZK0F2eBaGyEM\/RWagzBshe3FDt42KwP9fvYW1ZE\/Z7\/OcmZ4HAEyfrXf3ftef1KO\/6pnR3kB7PmjrD1I+dc+S+FPZHfkg3D1pueI+5SYB4EhZcaBEk1kwkxNdFR6aDOoDYAcIx9mM7Au22PzNay635T04rTegDN75ClY\/j\/Xp7p0EdPrF3ls8hkB6dqPh\/kVQB6824K2BqB1sJ7zJSsB+gpxA13cc6QIS3q5cue0cIvdWLw2l7GjSzVSl4OBFjvdX0GwitV+jxTm63p7Ki9xX55gKMiA2AYsiMhq1CNK9HIA+vNBtnIwd3ZMuL3B90iUw+5M7EswoattuHAVH\/+cZ8wWk11RJPaJ4Vv1TSJmJgyxFhC6o7O4DfhSi+MVxufheIeNhHV8XglNSzZeuyklCPyUbgIIUy9pFcAKCKGRhcMapJGXQIrZ8sHR\/eP0jCvToOWRZKP6TofS45tgBk5PO2AmurNrqE35foL2deHMP7sp4fiRF+J+s4LqFseco71R6RISXm+pf+DO3jXzsWIWv3nG4pxGNyYVtTAPgbeTffUEgUFlGKX8vU4w9QiD3qxNNmAYxMagTe\/UY+yLQuWc\/4Li0sGcP5USGiH0QrRcXpra9tjCGiFdDP8brKjYbmg9LTiYCQBEuwVwxjr9vBddmL66yEM2uNSd0FxXSwj51rQ\/JfdtGEmj7TXaxKrjEHBj0JNLu6aMeEwPp36ljFQL5S3cKgvvjeuoafqZWDoCW1Yn2aJzYrxiQuWjLtmnysnX9FtZqJJP1Kfv75CvJYt5mYkq2yJbIu7j4mRo5Da7QaQ7f66WI+PBor122ENK73PjOHV+pIkLTLqrRC30FS+c27nOvvzG7xmdCi7tWolTTQlCoBXJaROt7QNVnMaNBTbRbN4f0oB3P4S7PWAefPQNMvxfWMcujMYwmCfFDC7PayxHHI\/BKlnR8qWtWUfMDJ+8endRMsi2gupthD4ZMvW5wBeJebcqy4uCCvgu8zP\/vhd6l8IlFyAePIHgGlDMtSaZPvcH0X4VcPtAc0obDNMbpSikTAtaLMZ6xe8OxfEmAOH+uZk3MXGpfUq223enCTcqZvIbqo6lhjC8RAtCjSV37+JiKr8TCmoRSlK+QhThg+kk9lkz+dO0kDo9UQqM2UMqiqrGhc7vizDGLtjj7Al9uA1aQkdv\/v5JwTyWE2VESS\/xIFLRHFHIC+nJhHstwY7C8Pd4AqJaaM2VSftLuwQJOEYDePzRyNT5qCl96gbFc4QTwpp4WHuigKp1WeOQ92J0X8\/xGmtFjpEY0YjrQiAvb0OoW5VaU0mR0qHvQwTUF5qrKw51UD4+pMz+YcLYaNij11abw3LRPLxaeWlbMA2UqTVMQ4e951l4JPAZYTSnTHYWkssnsyeyJGu3uRIGveqblrg\/zZA6EjY6HhriZxsUZvPJfqkK5ZEVSPNXS0q7wGd12UngaVzEeEurCMf1UZ5AVqMQwl3Or2Oa6dYOsHnpM80t8nvNTrGPF6b4DgUeRh0Kc6flCqpmQ\/TNJusC10PdEPKtMSbbUgjkDlm8dP3ibtLirqfdJM62PmG9EPh9QvMqav9wfFX5kbDh0\/YN8YgZDRT00sbeeDnBC7OKVUMVS5nnCGpjtCKICj\/BYnXQj57+w+1MjNE40WIqZzK4mC9FHHTVe7WW1ljG3lTxFCYynHqEF+ZBiFPdT3ah9spQWbiM5qThK+rrPLmWHwNsqqLh584O3YXDqjyKIH0j6Hn0tw5knHK1u6IvUxIn2JLygv44Q34EKJvSPo66bdvrLago9gR23dDLHw8ium\/AKa2UrO6B7PiyG1Wp16ofzLLi286X19tIpxl\/h1PgKzV4TTVGMIlqP16TUEragK31mJhqd7qkKx\/uaBIwnH+pQVZmyL5LfcVlJhzvgJLLAshjkgHBN+ZjEY6kqmKguGuGnlQ7c9y\/9jf5VPIMihor4rC7QzXj3ByRy3vagp72iLcIoHx16+GqjGE2CFnA1hqVeoS4s+it5kwPBMXQvai72tH3eELFVZArZTq80QnL5JvHqMFEOEZgLhdbbKOfFuRchHxcLFAub1KSlhLyNOzGb6IObjyKd8qEc9udkMm4REB9vIWcdJeN1O\/499hKi2NPha0ev\/IlG6j0s+X2Nr08z2rzU5TSdJHgOcV44cl\/SKptHj5PCk1mX0NP315hTPnmlWtUlv0rOdpRtQZ+MShaX2CgwvdIrWA6GXTptlHv1Qf6Wf98KsOHtDW5xsWo+hpKPC+GwvkXCt+\/tFlTerIMqkXCFt2Ag2anZ247yas92XPQbDtPDPWhjXTAiegOBqvPS69t5cMGmQIFFpO72Q1BQb3t3UDd6eX3bS2GuSsbB1t9H59ndSl0PYbfS6tOLxJDQThyeDuleoW8DID3pk1jQpzEE0tqN2p8n5VeCv3K3MhvqwKCCTqK6GTrM7EBP2mI220y60ndTkUhUMMw+eCu\/aXc+qd3CL8x\/JN2je6S+Ovv\/tTF+y5ChsFrAQT2CSdkGkyMsp0o1XuIE1xABmS9VkaZu\/F48m+dVikPTvZYKk\/R18cTZHL2UlEBwhDT2n5CiKqqou9Oh6mkZjFUFEzoyZ3oCzLUp7I8FrPOMKI8yySy\/p5qlAEsDW14iEenpYs29j23dUZ2k371d\/W\/yok3IIjY+j7UfVbTL324c3+Sor3gm7x9nodO5vu\/07IxJqNIBM6xM\/WUX2KUwAniMgCR9cNbFczQ5jWfY05liwNyxmFaJPOjK2occsbg6zwNUZ9hY4LcMrkPga6NimGY2f1aEHNssGFERQnECiUfDWVgqIjzHROlI+1gGi\/\/rQP90OGtslGxgJFR2cZip0QDAAGyP7sKnjteXn4XaJt+XmPO5enL0uLv2B7T2NLzKDB6jR+jDgEshx4QveoHRcexAt8VWGVyDDj3hpzapqo+E1gndhjzOIU5MPsWXqQZ2rgamN0jl6SRKgQNQ6wA+cMpiguAcgf5ogPUrlMHBoR4Tjp+ycQzcQFJBImJEn2kYYZ8BGzNELrFWzCk6qC3UMfY2MGYkgA3vz+jcwSXw\/EGZELVWy0dK4fBZQ6VMRxZcI68fftu0bweb\/xYMRqJRJG3RSNwoV4wEdFBBkr3LfbFZRWo\/2sEwIrP+ECEMmV4dWfpMUWlw8KuAipxiT2Lw\/WbR\/klyIXgpA\/oDtS7OzAM5bzIdHga5PdS4NtoyXvN6s8SnwBU4+1OBNCbJigfS7gVLVcqmchsixYAQFcHWRSuGj7VUT9y5knZlfqlnCADaRRY2FZM5l8nmDY7MXzF7o5u5oNoama6RHXrIzuOyjVFY5dRbPieEQpRVe6ynvvN5+LIJUq2j7LoAa1BblmsH02F0eSzipelkO2MOgSyQ3C15v00PdvDrTNiZyk3jGzVUcdwCsu5fh65WOQ4ew0eq96VtY\/mrcgZpJN5H5ftWRXJJqK5sJzJ5gUK016NwUonBbHtzvVqPibzKUbgLFvyUdC1g8VK8GGE05zqLaMumBo51sw8f86AIxp6Bb6v3ugLaC98yCku0VlWGWMOUODSR9BDxo0Wl\/HAYvG8uJqrafnX4iaGLyiYh5Tj086kaMxr+DSqPVotaExBQO4c2xqH\/tC365pnfGtOFzyRHHEIhWwYQqcgGou2hkAhU4g0syd6pl92M8UvTWiXfwoXxDyFn+l0ZWwYH9JgEt0i7n6sp2ooOhPzLUXFBZhziFMx+5t5ic4nFMLWmjIEVJiC1TzGX3X2g6WGoNNGoJz3upaDtxAcQd7GXssrLFN0Uo+bfsR0GgBCQlBlMa5DPvu5OpdfqfeMSstJ4Gqbr4ESvQ8rThlUHET5Xd5UibQ0CKeSGR4qwqFiptfTTN9qRr3GGm\/c1kF44RHQBGJ\/zkDQUN5rhtZUZ9f4ozBCJEeRwfsrxh9IsJekfHdxvB+8sxjuHpPDXqijdsPO9SxHeGNCXFdmaTNdaSBpGUCijHLefeI92NA+NpRLh2Ew1wQymupi4W\/uBV9ip\/bASMbPpTId1f5\/ndoy3gIIN3aoJkUXlL0OD\/E3cpVh1z9mOMzGq8Qc+EZC25NqnFe02USEEh\/jg3JkPOFt\/0RvffH14+TJz8gscoGcV7rfox\/j1sMo84lZMVxJIsPR9lgFNHHUhxCoRJnvISvZ92WunqhRJcusLdcmXj2wdfwyZtNnRXNloKuHUlS19p+CO087khNSutKL2X4hCuSztmdj29bThExttOj1pRcwRxgDjCEDqPUZ6MB76gmKQJE0VUeQkZJN0h9URuMOomsfxYOV6VMaNWDpYhMR42oKBGGi9KNDMxO\/xamhACBCld24nCuF37tyS0q1+JV4EouEqpM8Nxplc7iEHcEbVzUyvpsLX+OBvkc3ht6fWnteTnGsjj+snGWSQS8V1o1X\/toUtvSvgvb8KFA7IBlk\/dTTjG6xQQCm60L1FXJD7H\/8N6ibBj9dbwj6MH4CpnzCXtzuVQra9XT5nxxgPLkYDAZ\/lVBkT8NglEO2mLtiRrxFY8IwTNRpZfAZj2H5tR0x1Tg8ij2vMna\/FQLAXG0V88Vr1KSPGX3mPHEjvZvw5SVSjtCwjKXofTXq8jGDvkgvb31CmrRe2EYknUE0Z1Fq+qJaJBhaf1j+JjKace3CMViGHuGq1Nn56lQLbur6Jb3Dg3\/rlSpruD\/npiPY6C1ETCU2sZu0q3DyhapO9MQ7FuiJTBzuUspmZV3t6Z3iUM\/fi1nuZ5gJmKJcE4zNoyK8ObvsGhzzSJwE7G22oTWQp\/pwS151TqzsxZ7\/0sj0ANrBbHxWxQHRrsdKDyx4CsWvGMe8gEvUV4NRsAutcS6oJXuVGx9UdJV4WgYD4k2a7e5bJgf+O47eHujmRF5EJ\/vhulvRBLUoSqbuq9gV5BIXjuuvXVDbaOB9wfN0+XHXmJwO5GxwObytboz59Kcne5jRZ5MRx4hjkJ1vlUIzQ1arPBjZBnMrUgJ7aelauDk6y6LuYTISQCUtf9XjOo4XlnMGNyV+LAgCGCkRTyuVPCqaSCnKxdCluBDU1MuL\/gyLqpXhIubWKnuqs6Sr4TIggil199LMt\/DLo1lhASvHqyTf3rSqlsBWPZaasJZlMXkqc2XjAH+W5ugS93nrv+xi7j\/lBr1krpojJkeYxDnNZaWXAatM+8GXQp1En2nXyVOnyRRaxiRXU0RnVA8nhMLT6d0iKlIRKRsbmlFq0z\/Un5F9tuPnztnObXxOts3aGIq08pdl4A0WAFD\/0o3GWfjKIBOxdysZYXdD1fdUwGvj90WLfuj7WMrk2v+mEBQJpWEjWZ4joQ9eGfGMZlde8+1gswwEHKsXoQHnEtwuO2jjV4fvzV8Ml1FL4SITBjgQN9ACVDng9jYo7eoJFGVCo+SBChwfZCzJVie2WACu124bqojdXpeu\/6kjW\/hbrddANbZJXOvHozcD1YYj8YReoUL66XkdVejo6tdMWT5aZFlhYfIl+qK2LkERmDneMfwR\/p2pniTYdkU4G09IiQC+PTCGbWyeRhy+93\/EzzaV3x0VOSgaDIaIfuY21X9bTkEd69OCejYfPLpFIOVFQoJFUA7EJLxpySJ\/GWb\/NNbvvg5sUITcNzIq6ivTgp0cDYbLg3CFSE+MfI6\/sPL+HBOAap0oX6sSuQzhN5wwHdcl8JHQK0AunOykRSRtxTOo+w4joMqoGUoU5hdqRUF9HHvbpANLC4uQ37dD8xrEwDSHcNj3IRLpuXic9oGBuTFEd0YiX9167K44z\/8TbiIxq2cZDtRMORBBNZXqbCNoeZ2KgXAm3F8fizH32F3Nji7ZoXRChzo4YSXOUNA7WVVmVk+v00YgnMLmXWYtuf9sE9sYP4boJ1K7aL76FTWfmF8ALCTNho\/pafu2hgXrv7bMH2MOBF9tjXSnmMckFPUt6tvfrgyr\/2H0g+rDfRURhZl96rRJBb8sRUKkgBPkV7mgQ\/PplSrHlydoo63uh7GjVDBGhgWxWjLTqCuTMOKTQenZL3\/AkIh2JWo2WBz8klvZ6hR9DmIiRWuV0a4LbEUZ8PRNaEKM6aLR5zGiysdnzNN3zZZwClBylbxjXDqwqcxbVoz59Ac1nyiTE9lquZz4rgCFNfHO2BqDtrhG6dNWBDmBA6Ky6b++EcXQQe7MvHQr\/qKYNe+XyPDwOzxVfu1Pc8sDrLMRFhtD\/yoDohxwu3G1H2YUVzh2P47RCfaz2Q7WfNmef+NDuJkJ202V8RcpeeLAIXGNukcq9n44yzI9qCoD4OCESvXTvt7iFiW7w7bBGst7lJcMqrHBHHufwlQWjU9Wm57HUpaAxFdBT3V5n1MMIhYteUoELjoySPLqoVocoxEx7RIWtRrqrKaSpgcIG660236kWAidhsbOE4EsVpNuO6pqc6A8pyDZdSLpQ312oit\/l6\/vvsTuTskJwtFH81a5FtjVge9HQoIkQObXTkKMBW5ZESO\/unMbXUS5sRbLObvKtIqbT2ol8f5PlAixXk62yNEsM3SVGeAq+HFnl1Jq82lY+YDN4fgZLG1fjsKf7WDsgGAPl5M\/KkFM\/Qz6Li+KPhA01uOg9ObBbXqEwBBoX2pG+2ot7YWVWDulZZh1xFAL7QPzZw3M8Kd8Gee+Fe8HEP8kZEqjWAHYR\/tZH9J0K5v7wjkeAMG0xt2K9xAY+ZQou\/608P4k36J6BfEho4\/4UKxTsMvdJqsNuaEhE1OZO+Kt4srqdKIKp3ay\/GOJjtDNkX5PNwVuDzPwNRH9Z8FP77qayrPq3qJD+ox+oYEOHr1KzfKZhjUbCYUhigM7I0X0FcnbldbweThQ3fCpyH9c3yyaCtLS0Xn3J0OXpbWj+e2tSoFESfQrWbWbba\/+64nufuP0T3Ix+v6\/b82zM4+FNDgSUXPMvlRxl9iYbN\/18BJwfjleLAhIAV\/PLy1WTjP8rdcULnRVO45ESk0fuQva6vjxgK62ubi3erTOxbmcffL8T6uqzgtL7WF1xlnwUbFpe98uNXXhz1ZSV+KzincBlWSA\/xXR0Zfh5uotGeukoE44D3xpjObL2pxw+mrth7qqKsS3G0KxkYep3FgrYf7w3jPNxek+T0gmaSO7iyhNwHbEPk3LlfBc\/\/UJDDVnHrUJ980LfEgFjWCV9Y8htKNMrVVzX3kUTyjGHoX6Uc+Dknn2WYx1IcRULdEkfQlJtjdQLBAafJ1dgZ8LI36XhW9GkKcyx5KnyV3TCxvzIoIQgyeUBbNHZcZhcxkj\/gFw4NmoOto\/ehiVMCOMODNea2mZWRGxvu7ofV7+WshDhurXVNPM\/HoU2CSGl\/DDCebCQdTuCDlRng0aPd5kw==","iv":"e6619bce71446ebb51b0245a125312ca","s":"34957bdbcb3ebd88"}

The 2022 Lexus LX. Image credit: Lexus

The 2022 Lexus LX. Image credit: Lexus  Lincoln is encouraging use of its mobile app for service visits. Image courtesy of Lincoln

Lincoln is encouraging use of its mobile app for service visits. Image courtesy of Lincoln Lounge area at a redesigned Porsche dealership. Image credit: Porsche

Lounge area at a redesigned Porsche dealership. Image credit: Porsche