The Macallan holds many records for expensive whiskey sales. Image credit: Le Clos

The Macallan holds many records for expensive whiskey sales. Image credit: Le Clos

The value of whisky has risen 23 percent in the past year, making it the strongest performing luxury asset class ahead of categories such as cars, jewelry and art.

Interest in whisky as a collector’s item has picked up significantly, particularly among the ultra-affluent in China and other parts of Asia. Knight Frank’s Luxury Investment Index for the second quarter of 2019 found that along with whisky, values for art and coins have grown by double digits between June 2018 and June 2019.

"We have seen a mixed picture among some of the more mainstream asset classes," said Andrew Shirley, head of luxury research at Knight Frank, in the report. "Growth in the classic car market, for example, has slipped into reverse gear, but investment-grade wine and art have both performed strongly."

Collection comparisons

Knight Frank added whisky to its Luxury Investment Index in 2018. The figures measured by Rare Whisky 101 show that the spirit’s values have more than quintupled during the last decade.

The 23 percent increase for whisky in the past year came despite some slowing of the category, driven partly by an increase in volume. One of the harbingers of the market, Macallan, has seen prices decline this year.

Rare Whisky 101 expects values to return to steady growth later this year.

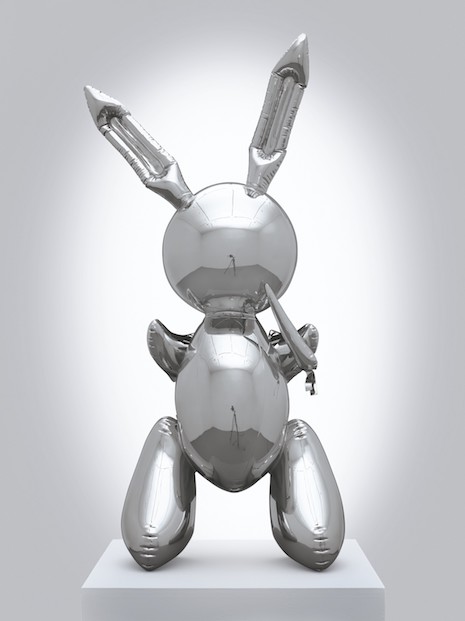

Figures from Art Market Research indicate that the art market is also having a positive 2019, with values rising 10 percent. This year has seen some blockbuster sales, including the $90 million Christie’s auction of David Hockney’s “Portrait of an Artist” and $91 million winning bid for Jeff Koons’ Rabbit.

Jeff Koons' Rabbit. Image credit: Christie's

Last year, Sotheby’s sold a painting by Elisabeth-Louise Vigée Le Brun for $7.2 million, marking a record for a female Old Master’s artist.

As auction houses and galleries look to sell to younger collectors, one standout trend is streetwear-inspired art. For instance, a work by KAWS, who has collaborated with Dior in the past, incited a bidding war that reached a record price for the artist of $14.7 million.

Along with whisky, wine saw significant year-over-year growth of 9 percent.

Meanwhile, watches were up a slight 2 percent from the second quarter of 2018.

While most categories saw growth, jewelry values fell 7 percent and automotive values declined by 5 percent.

According to HAGI, which provides automotive data for Knight Frank, classic cars are primarily being bought by enthusiasts rather than casual collectors. These aficionados are less apt to spend more than they think a car will be worth, resulting in a lowered collective value.

A McLaren was auctioned for almost $20 million. Image credit: RM Sotheby's

Despite an overall decline, there were still significant classic car sales, particularly Formula One models, such as a McLaren that fetched almost $20 million in a Monterey, CA sale and a Ferrari auctioned for $6 million.

Passion over profit

Despite the significant time and money wealthy individuals put into collecting art or automobiles, a report from UBS found that wealthy individuals typically do not prioritize the value of these assets.

For the quarter of well-off consumers who consider themselves collectors, passion tops the list of reasons why they choose to build collections, with profit a consideration for only 13 percent. While the average collector estimates their collection to be worth about one-tenth of their total assets, about half of these individuals have not had their collections appraised (see story).

For luxury collectors to get the most out of their investments, they need to focus on quality and passion, according to a group of industry experts.

During a panel hosted by auction house Phillips, speakers emphasized that while each generation may have different tastes, quality is timeless. A collector’s admiration for specialty items, however, should not be discounted (see story).

"Our research...shows that when it comes to these so-called investments of passion, it is the passion – whether that be the spine-tingling roar from the engine of a classic car or the emotions generated by a thought-provoking piece of art – that is still the prime motive driving collectors," Mr. Shirley said.