New data ranks global hotspots according to the rising costs of discretionary expenses, from luxury real estate and legal counsel to ladies' handbags. Image credit: Holger Pooten/Gallery Stock

New data ranks global hotspots according to the rising costs of discretionary expenses, from luxury real estate and legal counsel to ladies' handbags. Image credit: Holger Pooten/Gallery Stock

For the fourth year in a row, Asia tops a list of regions requiring an above-average reserve of wealth to live well.

Research conducted by private banking corporation Julius Baer arrives as part of the Global Wealth and Lifestyle Report 2023, now live. Composed of two parts — the bank’s Lifestyle Index includes a global city ranking, while its Lifestyle Survey weighs qualitative considerations impacting affluent populations’ quality-of-life — the 66-page release sheds light on the status of HNWIs worldwide.

“Price rises in premium goods and services underpin the case that wealthy consumers need to achieve a high single-digit investment return in U.S. dollar terms to preserve their wealth,” said Christian Gattiker, head of research at Julius Baer, in a statement.

“These findings also support the insight that solid currencies and, in particular, assets denominated in such currencies (e.g. the U.S. dollar or Swiss Franc) can help to weather these storms and secure a healthier, wealthier future.”

For the report, Index data was compiled and analyzed by IPSOS on behalf of Julius Baer and is based on the prices at the time of data collection from brand-owned boutiques, websites or authorized vendors for items in 25 major cities. The firm's Lifestyle Survey questioned high-net-worth individuals with bankable household assets of $1 million or more across Europe, APAC, the Middle East, North America and Latin America on their behavior in relation to their consumption of products and services, and financial needs, between February and March 2023.

Regional ranks

The Julius Baer Lifestyle Index ranks 25 total metropolitan hotspots according to the rising costs of discretionary goods and services in each region, from luxury real estate to legal counsel, drawing a picture of the relative asking price for maintaining high-net-worth conditions in a number of urban centers around the world.

Indeed, analysts confirm that prices for all goods and services listed on the Julius Baer Lifestyle Index have increased by 13 percent on average in local currencies, and by 6 percent when measured in the U.S. Dollar, over the past 12 months.

How expensive is your city for living well? Explore our rankings and more in Julius Baer's Global Wealth & Lifestyle Report 2023.

➡️ Download our report now to get the full list of cities: https://t.co/RNhgulS1kw#GWLR pic.twitter.com/FRuuipNqaC

— Julius Baer (@juliusbaer) June 20, 2023

Overtaken by the Americas, the most affordable region in which to live well turns out to be Europe, the Middle East and Africa (EMEA), in a flipped first-time occurrence backed by the fall of London from second to fourth spots.

Seven of EMEA’s destinations declined in status in 2023. Dubai stands as the district's only ascendant, reaching lucky number seven.

Six of Asia’s cities rose to higher levels as four fell, keeping the lead as a global economic powerhouse compared to the four rising and one descending American markets — New York has hopped up to fifth place.

In fact, this year’s three highest-ranking contenders belong to the world’s most populous continent. For the very first time, Singapore is the Lifestyle Index’s foremost property, replacing last year’s winner, Shanghai, which currently slots in second, followed by Hong Kong.

Independent actors agree with the assessment. Data intelligence company Altrata, for instance, listed the Southeast Asian champion as a favorite among UHNWIs in a 10th-edition Billionaire Census 2023 published earlier this month (see story).

Beyond the margins

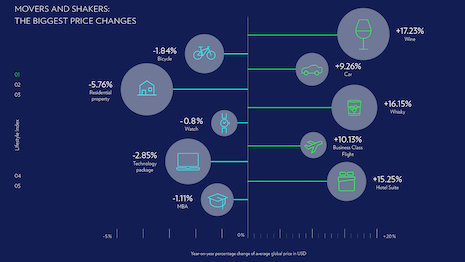

In digging for the Index, the bank discovered that high-demand, premium consumables such as wine and whiskey, as well as luxury cars and hospitality services, carried the greatest price increases this year.

Hotel suites, business class flights and fine dining have also fielded significant price hikes, fueled by a heightened demand for travel and entertainment.

The latest edition of the Julius Baer Lifestyle Survey has expanded to include North America, Singapore and Qatar, citing the inclusion of more detailed questions about health and wellbeing, sustainable practices and financial situations, making clear that substantial cost-of-living changes have shifted the values that anchor affluent consumers.

High-demand, premium consumables such as wine and whiskey carried the greatest price increases this year. Image credit: Julius Baer

High-demand, premium consumables such as wine and whiskey carried the greatest price increases this year. Image credit: Julius Baer

Overall, results suggest that those with outsized portfolios are widening their definitions of wealth to include physical wellness, in addition to financial health.

An evolved mentality, one that embraces the “future-proofing” of body and mind, prevailed as part of this year’s Global Wealth and Lifestyle Report 2023, per experts. For example, Lifestyle Survey respondents listed the health of themselves and their families as one of a select few post-pandemic priorities.

Building better relationships within personal networks involving family and friends also ranked high. Both insights align with external industry reports (see story) though it appears that, despite renewed focuses, HWNIs have yet to allow work-life balance to contend with business savvy.

Perhaps most notable of all findings, at least a quarter of the cohort told Julius Baer that they invested more during 2022 than in the previous year, a reality that rang true for rich respondents across all regions.

A sizable portion has upped investment allocations in the last 12 months, suggesting that those at the peak are not shielded from the pressures of inflation pervading everyday life, deploying recently accrued capital to help navigate the uncharted economic territory unfolding on an annual basis.