Housing market is experiencing a plateau after record sales during the pandemic. Image credit: Redfin

Housing market is experiencing a plateau after record sales during the pandemic. Image credit: Redfin

The hyper-competitive housing market resulting from the COVID-19 pandemic appears to be slowing down, as price drops passed 4 percent for the first time since September 2020.

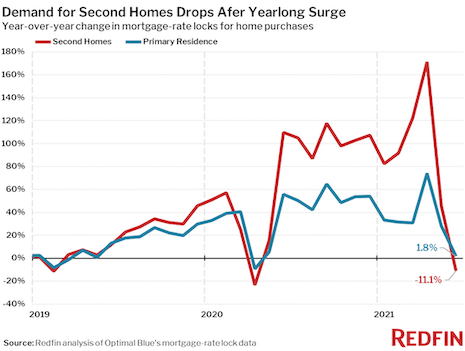

According to new data from real estate brokerage Redfin, pending sales were up 11 percent year-over-year, but down 11 percent from the 2021 peak. Additionally, the demand for vacation homes also seems to be dwindling as mortgage-rate locks for second homes fell 11 percent year-over-year in June after a year of double- and triple-digit growth.

"The pandemic sped up many peoples’ plans to buy," said Daryl Fairweather, chief economist at Redfin, Seattle.

"Folks who had planned to move in six months or a year decided to move quicker, whether it was to a bigger house that they could work remotely from, or an entirely new metro area closer to family, friends or amenities," she said. "Quarantine made many people realize they needed more space inside and outside, and preferences shifted toward extra offices, rooms to homeschool in and bigger yards."

Slowing market

Despite the increase in price drops, the median home-sale price from more than 400 U.S. metro areas increased 21 percent year-over-year to $365,500, a record high. Asking prices, however, have plateaued since May 2021.

"New listings have increased to pre-pandemic levels for the first time, giving buyers more options in what is still a highly competitive market," Dr. Fairweather said. "Buyer fatigue, seasonality and more homes on the market is starting to cool things down, which we’re seeing through price drops and a decrease in pending sales.

"Asking prices are still high, but buyers may start to regain some negotiating powers."

Demand for second homes dropped after a year-long surge. Image credit: Redfin

Demand for second homes dropped after a year-long surge. Image credit: Redfin

Asking prices of newly listed homes were up 12 percent from the same time a year ago to a median of $361,700, up 0.5 percent from the four-week period ending July 4, but down 0.6 percent from the all-time high two weeks ago.

New listings of homes for sale were up 3 percent from a year earlier. The number of homes being listed is in a typical seasonal decline, down 8 percent from the 2021 peak during the four-week period ending May 23, compared to an 11 percent decline over the same period in 2019.

Active listings fell 30 percent from 2020, the smallest decline since the four-week period ending Jan. 31, and have climbed 9 percent since their 2021 low during the four-week period ending March 7.

More than half of homes that went under contract had an accepted offer within the first two weeks on the market, well above the 44 percent rate during the same period a year ago, but down 4.2 percent from the year’s peak, set during the four-week period ending March 28.

Sold homes were on the market for a median of 15 days, an all-time low that has been flat for the last four weeks, and down from 38 days a year earlier.

A record 55 percent of homes sold above list price, up from 28 percent a year earlier. This measure is plateauing, however, having been 54-55 percent since the four-week period ending June 27.

The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, increased to 102.3 percent, meaning the average home sold for 2.3 percent above its asking price.

During the pandemic, homeowners flocked to resort towns such as West Palm Beach, but now seem more interested in primary residences. Image credit: Redfin

During the pandemic, homeowners flocked to resort towns such as West Palm Beach, but now seem more interested in primary residences. Image credit: Redfin

Mortgage purchase applications increased 8 percent week-over-week during the week ending July 9. For the week ending July 15, 30-year mortgage rates fell to 2.88 percent, the lowest level since mid-February.

From January 1 to July 11, home tours went up 23 percent, compared to a 50 percent increase over the same period last year.

Preference toward primary homes

Demand for second homes started surging in June 2020 as pandemic-related lockdowns and remote work made vacation destinations ultra-desirable and affluent buyers took advantage of low mortgage rates (see story). However, with the pandemic winding down, vacation-home demand is declining.

The drop in the year-over-year growth rate is somewhat exaggerated because mortgage-rate locks for second homes soared in June 2020.

After accounting for the impact of the June 2020 surge, Redfin finds that demand for vacation homes is starting to slow down but is still slightly above pre-pandemic levels.

The price-growth gap between seasonal and non-seasonal towns has narrowed since the height of the pandemic.

By the end of 2020, Redfin reported a 60 percent jump in luxury homes sales in the three months ending Nov. 30, almost four times the rate of growth during the winter before the COVID-19 pandemic took hold of the United States economy (see story).

Home prices in seasonal towns, where second homes are often located, rose 28 percent year over year in June to $468,000. June marks the 12th month in a row of 10 percent-plus year-over-year price growth for homes in seasonal towns.

Meanwhile, home prices in non-seasonal towns were up 26 percent to $421,000. The price-growth gap between seasonal and non-seasonal towns has narrowed since the height of the pandemic.

The discrepancy peaked in September 2020, when prices in seasonal towns increased 22 percent year over year, versus 13 percent for non-seasonal towns.

"The boom of affluent buyers purchasing vacation homes during the pandemic is subsiding," Dr. Fairweather said. "Demand for second homes is still strong, but for the first time in over a year, primary-home demand is growing more.

"With the pandemic diminishing in many states with high vaccination rates and folks returning to work, the allure of purchasing a second home isn’t as strong," she said. "On top of that, prices are still surging and lending standards are tightening."