Brands must adapt to changing values of consumer markets as sustainability and responsibility become key. Image credit: Bain & Company

Brands must adapt to changing values of consumer markets as sustainability and responsibility become key. Image credit: Bain & Company

A push by luxury brands and retailers to highlight unique in-store experiences came to a sudden end with the onset of the COVID-19 pandemic, and the fallout will continue into 2021.

Months of shutdowns brought on by the health crisis served to further accelerate retailers’ and shoppers’ adoption of ecommerce. While it will take months and years for luxury retail to fully recover, digitalization and sustainability will take on larger roles.

“Technology will play an increasing role in enhancing product discovery, using video, livestreaming and better storytelling,” said Marie Driscoll, managing director luxury and fashion at Coresight Research, New York. “We expect luxury online to become immersive and allow clients and potential clients to suspend disbelief and enter the brand’s world online.”

Here are some of the key trends heading into 2021 as luxury retail looks to smoother sailing:

Return of bricks-and-mortar

While many key luxury markets, including London, Milan and Paris, are under varying sets of restrictions to stem the spread of COVID-19, brands will not be moving away from physical retail.

“Investment in physical assets remains a must for brand discovery, brand building, brand engaging and more,” Ms. Driscoll said. “This year, we saw physical retail increasingly used as micro-fulfillment centers.”

Consumers embraced retailers’ expanded fulfillment options, including buy-online-pickup-in-store (BOPIS) and curbside pickup, as many remained wary of in-store shopping (see story).

With deployment of COVID-19 vaccines now underway, shoppers are expected to return to stores — but it is a matter of when and to what extent.

“I think as soon as we hit some kind of critical mass, or before, foot traffic will return, especially in urban areas where people are kind of locked in their apartments for the winter,” said Paula Rosenblum, managing partner at RSR Research, Miami. “However, the bigger question is, will it be pent-up demand and a novelty that wears off, or will things ever return to ‘normal?’”

“My suspicion is that unless operators make some really exciting changes to their store experiences, it will be short-lived,” she said.

Some brands are reevaluating their physical footprints, choosing to renovate stores or expand in-store offerings.

“When shoppers feel safe, they will return to local stores, downtown meccas and ultimately to travel,” Ms. Driscoll said. “Luxury shops are a special occasion for some and as travel picks up international flagship cities — which have suffered the greatest loss of foot traffic — will see a pickup in tourist footfall.”

Inside the renovated Gucci flagship in San Francisco. Image courtesy of Gucci

Inside the renovated Gucci flagship in San Francisco. Image courtesy of Gucci

In the summer and early fall, French luxury groups LVMH and Kering reopened newly renovated and relocated stores across the globe. Luxury label Hermès has also unveiled new and revamped boutiques (see story).

LVMH-owned Sephora is entering a long-term strategic partnership with department store chain Kohl’s, making inroads in many smaller markets where the cosmetics retailer does not have a physical presence (see story).

“Overall, in developed markets the physical retail footprint is likely to contract, but there will always be select markets where a new store is a plus for the community,” Ms. Driscoll said. “In developing regions, stores will likely be erected as demand for luxury brands grow reflecting economic prosperity, growing affluence and aspirational shoppers.”

Ecommerce and omnichannel

With prolonged lockdowns impacting the majority of high-end stores, luxury consumers turned to online shopping at an unprecedented level.

According to data from personalization software platform Qubit, categories including luxury and fashion have seen their online visits and revenues rebound from the start of the pandemic while others have stabilized after dramatic surges. To ensure continued success, luxury brands will have to continue to invest in their ecommerce presence (see story).

Neiman Marcus has introduced contactless curbside pickup during the pandemic. Image credit: Neiman Marcus

Neiman Marcus has introduced contactless curbside pickup during the pandemic. Image credit: Neiman Marcus

The fluctuations across sectors are likely to continue as affluent consumers continue to adapt to a post-pandemic society.

“People will be happy to dress up for the theater, going out to dinner and going to actual live event, but what about daywear?” Ms. Rosenblum said. “I suspect that category is going to be in trouble for a long time to come.

“Jewelry is another interesting category; I suspect that will come back and stay back,” she said. “The other implication of the stay-at-home workforce is less need for makeup.”

Social media, including Instagram Shopping and livestreaming, will continue to serve as an important avenue for brands to continue to engage with shoppers in the absence of in-store experiences.

BOPIS and other click-and-collect options will shift from a perk to an expectation for shoppers. However, brands will also be expected to invest in in-store technology that will replicate the online experience, according to Ms. Driscoll.

“We also anticipate improvements to CRM, where we expect to see greater integration between online and offline experiences, such as creating personal online dressing rooms where clients and brand associates can iterate a personal collection of products for try on in store or try on with one’s avatar,” Ms. Driscoll said. “A single — and accurate — view of inventory is an absolute requirement with demanding shoppers and while the luxury department stores have this functionality, not all luxury brands do.”

Spotlight on sustainability

Sustainable and environmental efforts will continue to inform every aspect of the retail sector, from manufacturing and supply chains to packaging and marketing.

While the pandemic has grabbed most of the year’s headlines, affluent consumers have become more aware of sustainability issues.

When the economy sustains a recovery, Forrester predicts that consumers will further look to patronize values-based brands. This includes expecting brands to demonstrate their commitment to customer, as well as employee, safety as physical stores continue to reopen.

This shift is a result of shoppers having spent more time about the environment and other social issues during the pandemic (see story).

“Sustainability will be front and center for luxury brands,” Ms. Driscoll said. “Luxury brand leaders have effectively made a sustainability strategy a mandate for the luxury industry as a whole.”

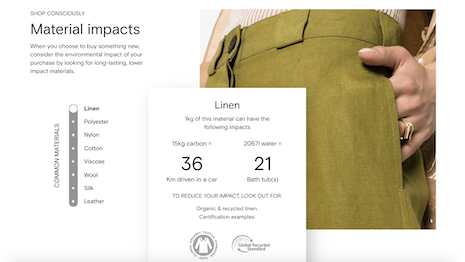

The Fashion Footprint tool is one way Farfetch is being more transparent about sustainable shopping. Image credit: Farfetch

The Fashion Footprint tool is one way Farfetch is being more transparent about sustainable shopping. Image credit: Farfetch

This summer, British department store chain Selfridges introduced “Project Earth” with the aim of changing shopping by 2025 through environmentally-impactful materials and circular retail models.

The initiative is also guided by Selfridge’s commitment to science-based targets and achieving net-zero carbon by 2050, under the guidelines of the Paris Agreement. Project Earth has a three-pronged approach: materials, models and mindsets (see story).

Meanwhile, LVMH’s environmental development department is looking to improve store performance with a variety of solutions. The group estimates that 70 percent of its greenhouse gas emissions originate in its stores.

Since lighting is one of the primary sources of the group’s energy consumption, the installation of LED lighting is one of LVMH’s store priorities. LVMH is also looking to improve the insulation, air-conditioning and heating, internal air quality, worksite management and ecodesign of its bricks-and-mortar stores (see story).

“It has to be real sustainability,” Ms. Rosenblum said. “The cost saving fake-out won’t work.”

While omnichannel and sustainability will be guiding principles for luxury brands and retailers looking to adapt and meet consumer demand, the health of the sector will ultimately depend on mitigation of the virus, strength of the economy and other incalculable factors.

“There will be pent-up demand,” Ms. Rosenblum said. “But figuring out what’s going to stick and what’s a momentary thing is very, very hard to predict.”