The report presents the top 100 largest luxury goods companies globally based on FY21 sales. Image credit: Deloitte

The report presents the top 100 largest luxury goods companies globally based on FY21 sales. Image credit: Deloitte

Luxury’s biggest brands are gaining ground at an increasingly rapid pace, according to data culled by consulting firm Deloitte.

Now live, and reflective of widespread rebounds for industry giants in a return to pre-pandemic commerce levels, the Global Powers of Luxury Goods 2022 reaches its ninth edition, as it details relevant data and predicts upcoming luxury trends. Regarding the latter, Deloitte’s report notes that the circular economy and resale, as well as Web3, are areas that will see the most brand engagement in 2023.

For the report, Deloitte presents the Top 100 largest luxury goods companies globally, based on their consolidated luxury goods sales in FY2021, which the firm defines as financial years ending within the 12 months from Jan. 1 to Dec. 31, 2021.

By the numbers

This year’s Global Powers of Luxury Goods report spells out just how far ahead the industry’s top players are in terms of both sales and profitability.

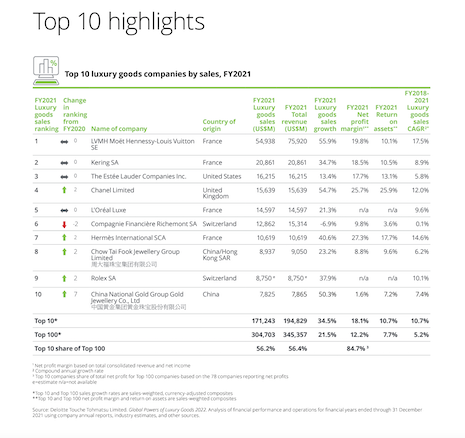

Of the 100 bestselling luxury goods companies analyzed, businesses belonging to the top 10 made up more than half of total sales, at 56.2 percent, jumping nearly 5 percent from 51.4 percent in 2021.

This group of luxury leaders also accounts for almost 85 percent of the top 100 brands’ total net in FY2021.

Conglomerates make the cut, topping the list by large margins. Image credit: Deloitte

Conglomerates make the cut, topping the list by large margins. Image credit: Deloitte

Deloitte’s data reflects that the 15 luxury goods companies charting sales of more than $5 billion pulled far above their weight in performance, contributing more than two-thirds of sales from the total Top 100.

Coming in at only 6.7 percent were 45 companies of Deloitte’s 100 bestselling brands, with sales amounting to $1 billion or less.

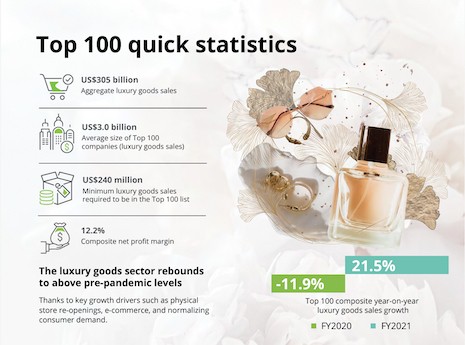

By all measures, however, this 100-company-wide cohort shows signs of a collective rebound, recovering from COVID-19 pandemic losses at a rate increase of 21.5 percent year-over-year, due to store reopenings and refreshed consumer demand.

Further, 73 of the 100 companies reported growth in luxury goods sales in FY2021 according to Deloitte’s reporting, versus just 20 in FY2020. Additionally, experts share that the 20 fastest-growing luxury goods entities grew nearly three times faster than the Top 100 as a whole from FY2018 to FY2021.

Luxury goods are clearly continuing to climb the sales ladder, as its top performers attempt to take all.

Next up for luxury

Besides a rise in Web3 use, Deloitte states that the circular economy and conscious consumption present the greatest opportunities for luxury brands attempting to demonstrate substantial returns during upcoming fiscal years.

Analysts predict 2023 will lift the relevance of resale to new heights, as brands get on board with the market’s proliferation by integrating new digital solutions like blockchain authentication to offset counterfeiting risks.

Deloitte's luxury goods statistics at a glance. Image credit: Deloitte

Deloitte's luxury goods statistics at a glance. Image credit: Deloitte

In good news, AI-powered authentication service Entrupy’s latest “State of the Fake” report reflected a decline in the rate of fakes sold through partner consumer-to-consumer (C2C) marketplaces, down to 5.5 percent in 2021 from 10.8 percent in 2019 (see story).

Many have already begun to capitalize on secondhand clothing.

Take Balenciaga — the luxury brand has invited consumers looking to sell old styles to drop designer items off at participating Balenciaga locations or simply schedule a pickup. Items are then photographed and listed for sale, executed in collaboration with circular technology platform Reflaunt (see story).

German fashion group Hugo Boss has launched its own branded resale platform this year, as part of the group’s Claim 5 sustainability strategy (see story). U.S. fashion label Oscar de la Renta has also entered the market with their “Encore” service, which puts a unique spin on secondhand luxury with a curated selection from the archives of collectors, clients and vintage boutiques (see story).