Brands such as Michael Kors are losing revenue to the gray market. Image credit: Michael Kors, fall 2017

Brands such as Michael Kors are losing revenue to the gray market. Image credit: Michael Kors, fall 2017

Unauthorized distribution of products on Amazon, also known as the “gray market,” can be detrimental to any brand, but luxury accessories makers tend to be the hardest hit.

High-demand, high-price products in general are among the main targets for distribution on Amazon’s gray market, but accessories have the largest ratio of third-party to first-party listings on the ecommerce site, according to a report from L2 titled “The Battle Against Unauthorized Sellers.” Brands can protect themselves from harm from these unauthorized sellers by taking a more active role in how they, and Amazon as well, handle their relationship with third-party distributors.

Gray market

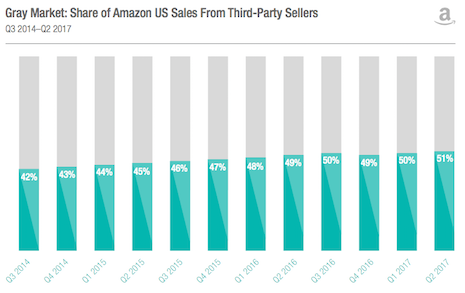

Brands are aware of Amazon’s gray market, but the specific effects of unauthorized distribution through the ecommerce juggernaut are only now fully coming to light.

Amazon allows third-party sellers on its site who sell products without requiring the full authorization and permissions from the brands whose items they are providing.

This has led to vast amounts of products being sold completely without the knowledge or behest of the brands.

The sector most heavily affected by this is high-price accessories brands.

For example, L2 found that U.S. apparel and accessories label Michael Kors appeared 143 times on the daily Best Sellers list on Amazon in the Handbags & Purses category between July and September despite the fact that the brand does not officially distribute in that category at all.

Gray market brand risks. Image credit: L2

What is more is that Michael Kors’ official goods on Amazon average a five times higher price than those unofficial products distributed through the gray market.

L2 has identified the top six sectors that are most at risk for encroachment by unauthorized sellers who can steal revenue from the brands involved. These sectors are, in order of most vulnerable to least, women’s watches, women’s sunglasses, women’s handbags, men’s sunglasses, men’s watches and women’s jewelry.

What brands can do to combat this is work closely with Amazon and trusted third-party sellers to crack down on the gray market and remain vigilant on unauthorized sellers.

Additionally, focusing on unauthorized sellers that make Amazon’s Best Sellers list will ensure that the highest-priority targets are handled first.

Unauthorized selling

Amazon is set to eclipse Macy’s as the largest seller of apparel in the world by the end of 2017, making it an area of priority for anyone in the fashion industry.

While much of the apparel sold on Amazon is from mass brands or Amazon’s own Amazon Essentials brands, another report from L2 shows that there are thousands of so-called “gray market” options for consumers to buy luxury apparel from unauthorized third-party sellers (see story).

Gray market sales. Image credit: L2

Amazon is continuing to challenge the fashion industry with the introduction of Prime Wardrobe.

Prime Wardrobe is currently in beta testing and available only to Prime customers that the retailer has selected to pilot the program. During an era where traditional department stores are facing declining sales and consumer disinterest, Amazon has only upped the ante on its fashion division’s happenings and service programs (see story).

But Prime Wardrobe is less likely to be a problem for the most expensive luxury fashion items. The real problem that many brands face now is unauthorized selling on Amazon’s gray market.