Five key trends will be prevalent throughout the industry in 2024, according to the findings. Image credit: The Future Laboratory/Stephane Boubert

Five key trends will be prevalent throughout the industry in 2024, according to the findings. Image credit: The Future Laboratory/Stephane Boubert

Bacardi Limited, the world’s largest privately-held spirits company, is dishing in the latest consumer behaviors impacting the beverage industry.

The 2024 Cocktail Trends Report, created in collaboration with U.K. think tank The Future Laboratory, identifies five key trends set to dominate the market this year. As in most corporate businesses, technology and AI are front of mind, with travel and non-alcoholic offerings also said to be paving the path toward the future.

"Collectable cocktails is a key trend to watch for the luxury drinks industry in 2024," said Alex Hawkins, strategic foresight editor at The Future Laboratory, London.

"Next-gen luxury drinkers are embracing a ‘less but better’ approach, continuing to support the ongoing premiumization era for key spirits, liquors, and NoLo categories," Mr. Hawkins said. "With a conscious approach to the economic climate, consumers are seeking smaller luxuries – looking to elevated lifestyle products as must-have pieces.

"Cocktails, spirits and liquors that capitalize on exclusivity, quality and cultural collaborations have never been more in demand, occupying a fresh space for consumers between lifestyle and luxury libation."

Bacardi commissioned the Future Laboratory to produce this fourth-edition report. The publication draws upon multiple surveys by Bacardi on consumer preferences and brand ambassador behaviors, internal data from both entities and research from external firms.

Looking forward

Five trends will be prevalent throughout 2024, including lessened alcohol intake, new and unique aging methods for dark spirits, increased ties between trips and sips, a focus on sustainability and personalization through technology, as well as the impacts of artificial intelligence.

As spirits overtake wine in sales for the first time in nearly 50 years (see story) and young people drink less and less (see story) due to economic factors and movements such as Dry January, beverage brands are adapting to new customers' demands. Many consumers are opting for a “less is better” approach.

Seventy percent of those surveyed around the globe prefer to go for higher-quality options at a lesser rate rather than ingesting a large amount of low-tier libations. Of those aged 21 to 44 living in the U.S., the figure is 41 percent.

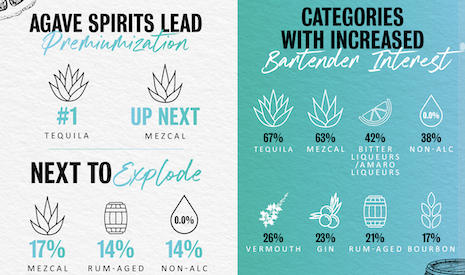

Tequila is leading in consumer and bartender interest. Image credit: The Future Laboratory

Tequila is leading in consumer and bartender interest. Image credit: The Future Laboratory

Three-quarters of all U.S.-based respondents are easing back on imbibing due to inflationary and economic pressures, perpetuating an overarching trend of decreased drinking. Non-alcoholic options are, at the same time, rising in prevalence, with a quarter of American respondents interested in consuming more of these NoLo beverages in 2024.

"The NoLo category continues to evolve, embodying 'The Sipping Spectrum,' where moderation is synonymous with choice, quality, flavor, and social connections," said Mr. Hawkins.

"This year, we can expect to see the category’s elevation and transformation, with its growing popularity driving a new approach to moderation, where NoLo moments become synonymous with choice, quality, flavor and forging social connections."

Due to younger generations’ preference for quality pours, pure spirits segments, such as whiskey, mezcal and rum, are attempting to harness this interest with bespoke offerings. Small-batch, limited-edition libations are becoming more prevalent, each taking on a different and possible experimental aging or blending technique to present a new experience for customers

Introducing new spices, mix-ins and pairings in both the distillation and mixology processes is becoming the new normal. According to the report, consumers are looking to deepen their palates this year, with woody, smokey flavors and “tea-focused ingredients” both respectively garnering nearly a third of respondents’ fascination.

Gin & tonics ranked as the most in-demand cocktail for 2024. Image credit: The Future Laboratory

Gin & tonics ranked as the most in-demand cocktail for 2024. Image credit: The Future Laboratory

Vacations are rising as the top times for alcohol intake, with those in France and Spain, Germany and the United Kingdom, with 49 percent, 46 percent and 39 percent of survey-takers stating as such. These times of escapism are breeding nostalgia for drinks such as the margarita, daiquiri, martini and others; at the same time, the firm predicts that new, elevated cocktail formats will emerge throughout the year to draw in more interest.

A focus on aesthetics is rising amongst drinkers due to the prevalence of social media, making visual appeal and photogenicism “extremely important” to just under a third of modern consumers surveyed.

"Entertainment is reclaiming its power-house status," said Mr, Raymond, in the report.

"With viewers extremely keen to engage in real-life activities and associated activations – brands are uniting consumers around particular moods and feelings, creating dedicated communities and engaged fans in the process."

New approaches

Sustainability and a focus on nature are rising among younger clientele, with 43 percent of the group planning to drink more cocktails made with holistic ingredients this year.

Backing this up, 48 percent of all U.S.-based consumers said they consider a company’s environmental initiatives before making a purchasing decision. The factor also serves as the top reason to pay more for a beverage, according to the global survey.

Flipping to coin from naturalism to the computer-generated, technology is becoming an increasingly prevalent part of the industry. AI is at the center of this trend, with 80 percent of respondents from the U.S., Germany, Singapore, Spain and South Africa planning to explore beverages with recipes generated by the software in 2024.

Looking ahead to the future of the spirits business and cocktail culture in 2024, @Bacardi commissioned The Future Laboratory to produce a new foresight report, anticipating the shifts that will shape the industry over the coming months. https://t.co/FLu8B0i83x pic.twitter.com/gT8hNrqKTp

— TheFutureLaboratory (@TheFutureLab) December 20, 2023

At the same time, six in 10 consumers from the U.K., Germany, France and the U.S. would “miss the human touch and connection of cocktail-ordering if drinks were made solely by AI,” backing up previous findings on consumer attitudes toward artificial intelligence (see story).

Champagne brand Perrier-Jouët is among the maisons playing into the demand for technological integration, debuting a capsule of Belle Époque vintage cuvées, with bottles covered in designs coated in 3-D printed 18-karat gold (see story).

“As the era of people-driven cocktail culture unfolds, drinks brands will foster a world where innovation, experimentation and betterment know no bounds,” said Martin Raymond, cofounder of The Future Laboratory, in the report.

“Centered on social connection, togetherness and ultimately experience – the industry has the opportunity to set an example for the wider landscape, recalibrating and refocusing us all on the things that matter the most.”