Google is revamping its Shopping offerings. Image credit: Google

Google is revamping its Shopping offerings. Image credit: Google

Google is the latest technology giant to invest in new features as it works to build a seamless ecommerce shopping experience across its platforms.

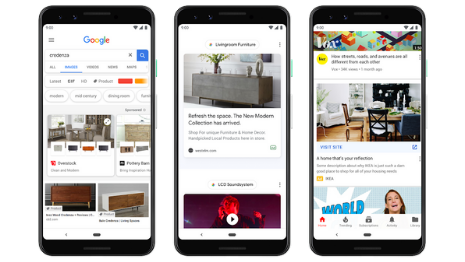

Hoping to capitalize on the hundreds of millions who already rely on Search, Images and YouTube throughout their shopping journeys, Google is redesigning its Shopping experience. In recent months, a number of social platforms have been introducing new ways for consumers to shop online and through mobile, similarly looking to bridge discovery and conversion.

“The new Google Shopping experience marks a shift up the funnel for Google – and a clear play against the major inroads on product discovery that Instagram and Pinterest, to a lesser extent, have made,” said Matthew Levin, global head of marketing at Nosto, New York. “Google Shopping combines the previous ‘all in one’ search, shopping and checkout experience of Google Express with a brand-new discovery experience in a single app.”

Google Shopping

Search and YouTube have long been part of many online shoppers’ experiences, but Google has not always taken advantage of this reality.

Forty percent of consumers in a recent Criteo survey named YouTube as a go-to discovery channel (see story). Additionally, research from ecommerce platform Nosto found that 79 percent of all mobile shopping sessions come from unpaid sources, such as searches (see story).

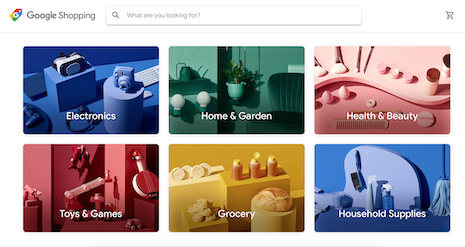

The new Google Shopping homepage

Now, Google plans to incorporate the best features of its checkout and delivery service Express into the revamped Shopping platform.

Users will be able to purchase products online, in-store or directly through Google. A personalized Shopping homepage also allows consumers to search products, filter based on brands and features and read or view customer reviews.

Leveraging the power of its brand, Google will be offering customer support for select purchases – denoted with a blue Google shopping tag – in an attempt to gain consumer confidence.

“With the new Google Shopping experience, Google is offering a comparable closed loop discovery to purchase experience, built on the back of a much better understanding of what products people want and buy,” Mr. Levin said.

Retailers and brands will also benefit by having a centralized location for advertisements and transactions.

To increase discovery, Google will expand Showcase Shopping ads to appear on Images and eventually YouTube, reminiscent of shoppable ads from Instagram and Pinterest. According to Google, about 80 percent of traffic from Showcase Shopping ads to retailer sites are from new visitors who have just discovered the brands.

Google first piloted a tool that enabled consumers to purchase an item by clicking directly on an ad in 2015 (see story).

Smart Shopping campaigns will use artificial intelligence to help advertisers where ads will appear to better optimize conversions. Retailers can integrate Shopify or Magento for these initiatives.

“Google continues to invest more resources into the Shopping experience,” said Evan Kirkpatrick, vice president of shopping and feed management at Elite SEM. “It is a priority for the company and we continue to see strong growth in impression and traffic volume across our clients.

“It is a more competitive marketplace than it was even a few years ago, so having a strong strategy and approach is essential for success,” he said.

Collaborative Shopping campaigns with retailers and brands will also be available.

In one trial application of this type of campaign, beauty group Estée Lauder Companies hoped to increase sales of their branded designer fragrances at one of its top retailer partners in the U.S. During the test, click share on Shopping ads for the brand’s fragrances at the partner retailer increased by 72 percent.

“The enhancements to Showcase ads should be of particular interest to luxury retailers,” Mr. Kirkpatrick said. “The ads can feature brand-specific creative and lifestyle imagery, particularly useful in the luxury space.”

Estée Lauder is one luxury brand that has experimented with Google Shopping campaigns. Image credit: Estée Lauder

Google Shopping also plans to emphasize click-and-collect services. A recent study from the company showed that 45 percent of global shoppers actively buy online and pick up in-store.

The tech company is currently recruiting retailers into its click-and-collect beta program, which will indicate to shoppers which items are available for local pickup or speedy shipping to stores.

Ecommerce competition

Although Google was not originally established as an ecommerce platform, it has made moves into this space over the years.

This spring, Chinese commerce site JD.com launched a store on U.S.-based shopping site Google Express. Joybuy, the JD.com Google Express store, is one of the retailer's ongoing missions in an attempt to compete with Alibaba and helps Google compete with Amazon (see story).

Google’s virtual assistant is also furthering its competition with Amazon's Alexa though a fashion style feature. Google Assistant has launched its own virtual stylist tapping artificial intelligence to determine appropriate fashion advice (see story).

In addition to tangling with Amazon, Google is also facing increased competition from Instagram and Pinterest.

Instagram has been working to streamline the shopping journey for users, allowing them to purchase items from brands directly without leaving its application.

Several luxury brands are among the first to roll out Instagram Checkout, including Dior and Prada. After making itself nearly invaluable for brands with the help of an expansive audience and a suite of advertising tools, the Facebook-owned platform is looking to facilitate an end-to-end purchase journey from discovery to conversion (see story).

Pinterest is continuing to make itself useful to luxury marketers and retailers with more commerce offerings. New features such as full catalogs, personalized shopping recommendations and shopping search aim to bring Pinterest closer to becoming an interactive retail platform (see story).

“Luxury brands that spend on activating influencers and paid ads on Instagram can now also spend on Google's discovery-oriented ads, with the added benefit of leveraging Google’s deeper understanding of lower funnel and likelihood to purchase signals,” Nosto’s Mr. Levin said. “This poses an a potential opportunity to link both top of funnel oriented marketing spend with bottom of the funnel oriented spend in a more efficient way without sacrificing reach.”