Giorgio Armani is introducing AR makeup try-ons on its WeChat mini program. Image credit: ModiFace

Giorgio Armani is introducing AR makeup try-ons on its WeChat mini program. Image credit: ModiFace

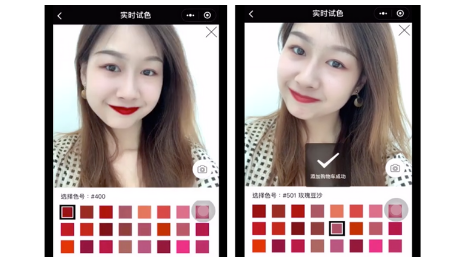

Italian fashion label Giorgio Armani is catering to the growing online market for beauty in China by becoming the first luxury brand to incorporate 3D augmented reality makeup try-ons into its WeChat mini program.

Beauty group L’Oréal’s AR makeup platform ModiFace will be supporting Armani Beauty’s virtual makeup application on WeChat, one of the leading social media platforms in China. More than a quarter of beauty buys in China are made online, underscoring the importance of prestige cosmetics brands investing in ecommerce tools.

“Today’s consumer wants to be a involved with something bigger than a brand boasting only status or legacy,” said Aleni Mackarey, chief operating officer at Base Beauty Creative Agency, New York. “She is looking for the brand that tells a story and creates a moment to make her feel like she is a part of the community.

“A try-on tool that allows her to be in the heart of the action earns her trust and keeps her coming back to see what’s next,” she said.

Ms. Mackarey is not affiliated with ModiFace, but agreed to comment as an industry expert. ModiFace was reached for comment.

Virtual makeup

Armani Beauty’s AR try-on is meant to mimic the virtual mirrors that are becoming more commonplace in Chinese bricks-and-mortar stores.

Users can virtually sample Armani products, such as lip colors, with the shades remaining consistent as consumers pose in front of their smartphone cameras. The app also allows users to take screenshots, save images, compare before and after images in a split-screen mode and share on social media.

Giorgio Armani is bringing virtual makeup to its WeChat mini program. Image courtesy of ModiFace

The beauty industry has been at the forefront of bringing AR uses to the masses, but this is the first use of 3D makeup try-on through WeChat. With more than 200 million daily users, WeChat mini programs such as Armani’s represent a significant ecommerce opportunity for L’Oréal.

Since acquiring ModiFace in March 2018, L’Oréal has partnered with platforms, including Amazon and Facebook, to bring AR experiences directly to consumers.

The beauty group’s partnership with Facebook allows it to bring the interactive technology to a wider audience, since many people are using the social network, eliminating the need for users to have to download the ModiFace app.

ModiFace technology is seamlessly integrated with Facebook, allowing brands from L’Oréal direct access to consumers for makeup testing. In addition to Giorgio Armani, brands such as Lancôme and Yves Saint Laurent allow users to try on different makeup looks virtually from their inventory of products (see story).

Previously, ModiFace integrated its AR into Samsung’s live video experience on its Galaxy S9 and S9+ phones, letting consumers explore makeup looks without needing a separate app (see story).

Along with ModiFace, Giorgio Armani also has a partnership with AR beauty platform Perfect365. The mobile app has been dowloaded more than 100 million times, and 65 percent of users are women between the ages of 17 and 34 (see story).

Beauty in China

China’s beauty market is of great importance to luxury brands, and prestige players such as L’Oréal need to continue to innovate as Chinese consumers are increasingly interested in trying lesser-known labels.

According to a new report from Reuter: Intelligence, 85 percent of women and 70 percent of Chinese men are curious about niche brands, and 92 percent of male beauty buyers say they prefer indie options. These brands are a growing competition for bigger labels, as consumers believe niche products put more investment into developing formulas than marketing.

Additionally, while Chinese consumers are heavily engaging and shopping on digital channels, they still value the bricks-and-mortar experience for beauty buying. The majority of consumers agree that physical stores enable them to try on products before buying (see story).

In China, 27 percent of all beauty purchases are made online, according to Euromonitor (see story).

L’Oréal’s sales were up 11.4 percent in the first quarter of the 2019, propelled partly by double-digit growth in its luxury division, including Armani.

In addition to L'Oréal Luxe’s buoyancy, the company also saw strong sales increases in Asia Pacific, at travel retail and in ecommerce (see story).