The report cited that 55 percent of Black Americans and 71 percent of white Americans reported stock market investments last year. Image credit: WoCinTech.

The report cited that 55 percent of Black Americans and 71 percent of white Americans reported stock market investments last year. Image credit: WoCinTech.

Black Americans are not building wealth at the same rate as their white counterparts at similar income levels, although younger investors are becoming more engaged.

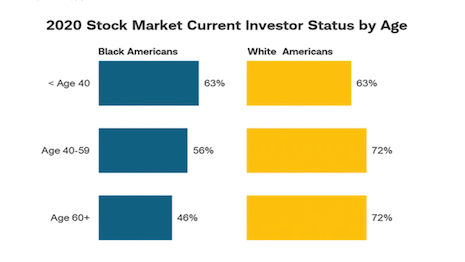

According to the 2020 Ariel-Schwab Black Investor Survey from financial services company Charles Schwab Corporation and asset management firm Ariel Investments, Black Americans are not benefitting from the stock market growth at the same rate as white Americans at similar income levels, with 55 percent of Black Americans and 71 percent of white Americans reporting stock market investments. This disproportion over time indicates that Black Americans will have less money saved for retirement and less wealth to pass onto the next generation than their white peers.

“Black Americans are already behind the eight ball, and it is disheartening to see that at current savings and investing rates, the wealth gap will continue to expand, endangering our futures and leaving our families exposed,” said Mellody Hobson, co-CEO and president of Ariel Investments, in a statement.

The online 18-minute survey was conducted among 2,104 Americans during the period of Dec. 1-14, 2020, with a mix of genders, all participants over the age of 18 and with a household income of more than $50,000 in 2019.

Key findings

Although the wealth gap is substantial and 2020 was an unprecedented year, many younger Black Americans are showing increased engagement in the stock market.

Sixty-three percent of Black Americans under the age of 40 are now participating in the stock market which is equal to their white counterparts. Three times as many Black investors as white investors, 15 percent versus 5 percent, report having invested in the stock market for the first time in 2020.

More than twice as many Black investors under the age of 40 (18 percent of Black investors versus seven percent of white investors) are reporting that they discussed the stock market growing up. Image courtesy of Charles Schwab Corporation

More than twice as many Black investors under the age of 40 (18 percent of Black investors versus seven percent of white investors) are reporting that they discussed the stock market growing up. Image courtesy of Charles Schwab Corporation

“These findings are encouraging for younger Black investors, but there is much work to be done to ensure that Black Americans have access to the resources they need to stay engaged and successfully investing for the long-term,” said Rick Wurster, executive vice president of Schwab Asset Management Solutions, in a statement.

Black participation in the stock market stands at its lowest level in the history of the Ariel-Schwab survey, which has been conducted for more than 20 years.

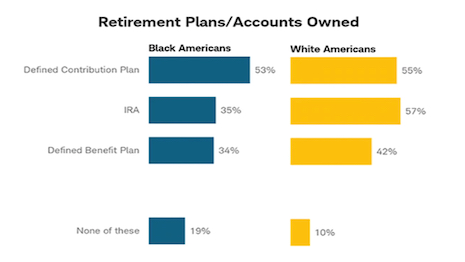

The report states that over the last several decades, 401(k) plans have served as an important gateway to investing for many Black Americans, with 63 percent of Black investors first investing in the stock market through a retirement plan. Almost as many Black Americans own 401(k) plans as white Americans at a rate of 53 percent to 55 percent, respectfully.

Saving rates however show vast differences. The report cites that white 401(k) plan participants invest 26 percent more per month toward their retirement accounts than Black 401(k) plan participants, $291 versus $231.

The report cites that white 401(k) plan participants invest 26 percent more per month toward their retirement accounts than Black 401(k) plan participants. Image courtesy of Charles Schwab Corporation

The report cites that white 401(k) plan participants invest 26 percent more per month toward their retirement accounts than Black 401(k) plan participants. Image courtesy of Charles Schwab Corporation

The survey also found that Black Americans are less likely than white Americans to own almost every kind of financial vehicle, with the exception of whole life insurance. Black Americans are also less likely than white Americans to have written wills, financial plans or retirement plans.

While Black Americans save $393 overall per month, white Americans are saving 76 percent more at $693 per month. Black Americans who earn more than $100,000 a year consistently save or invest significantly less than their white counterparts at the same income level.

“These differences are not new,” Ms. Hobson said. “Black Americans are disadvantaged from the outset when it comes to building wealth.”

While 51 percent of white Americans note that they have inherited wealth, only 23 percent of Black Americans have.

Although similar proportions of Black and white investors believe that financial service institutions are not trustworthy — 23 percent compared to 20 percent — only 35 percent of Black investors feel they are treated with respect by financial institutions versus 62 percent for white investors. Sixty-three percent of Black Americans are more likely to cite the importance of racial diversity within employee ranks at diversity firms rather than 27 percent of white Americans.

Inclusion awareness

The COVID-19 pandemic impacted Black and white Americans in disparate ways financially.

More than twice the amount of Black 401(k) plan participants borrowed money from their retirement accounts during the pandemic at a rate of 12 percent versus five percent of their white counterparts. Almost twice as many Black Americans took money from their emergency funds at 18 percent versus 10 percent of their white counterparts.

Despite the wealth gap, Black Americans are remaining optimistic. When asked to forecast their personal financial situation in 2021, compared to 2020, 60 percent of Black Americans said they feel as though their situations will improve.

Discussion of the stock market among Black American has also proved beneficial, with more than twice as many Black investors under the age of 40 — 18 percent of Black investors versus seven percent of white investors — reporting that they discussed the stock market growing up.

Many brands, companies and organizations are analyzing how to improve diversity and inclusion practices to ensure that all employees and consumers have opportunities to succeed.

Global publishing company Condé Nast is holding itself accountable with new goals founded on creating an equitable and inclusive recruitment, retention and talent development approach. According to its first annual Diversity and Inclusivity 2020 Report, only 10 percent of the company’s U.S.-based senior leadership positions are held by Asian employees and 5.5 percent are held by Black employees (see story).

Last year, Condé Nast shelter publication Architectural Digest produced a digital designer showhouse exclusively featuring Black interior designers, encapsulating a year that has seen brands embrace online platforms and commit to diversity like never before. Launched in November 2020, The Iconic Home showhouse is the result of a partnership between AD and the Black Interior Designers Network (BIDN) (see story).

LVMH-owned beauty retailer Sephora has selected eight brands that will participate in the retailer’s 2021 Accelerate incubator program, comprised exclusively of BIPOC-founded brands. Marking its sixth year, the Sephora Accelerate program focuses on cultivating an international community of female beauty founders and providing curriculum, mentorship, merchandising support, funding and investor connections to its participants (see story).