This year, Amazon Prime Day begins June 21. Image credit: Amazon

This year, Amazon Prime Day begins June 21. Image credit: Amazon

With ecommerce still thriving as COVID-19 restrictions are lifted, several retailers, including ecommerce giant Amazon, are looking to keep the momentum going.

As Amazon prepares for its seventh annual Prime Day on June 21, consumers are making plans to shop from the online retailer and other outlets. Driven by discounts, pent-up excitement and desire to shop for themselves, 55 percent of respondents from a recent Bazaarvoice survey said they have no fixed budget for Prime Day and will decide how much they will spend when they see what’s on sale.

“I think a large volume of the purchases that will be made during Prime Day will be impulsive, as many of the shoppers we surveyed have no concrete plans for Prime Day, and are leaving their purchase decisions to the day of,” said Keith Nealon, CEO of Bazaarvoice, Austin. “This means that on Prime Day, opportunity is ripe for companies not named Amazon.

“Consumers are looking to spend their money, but they’re not devoted to where, or how much,” he said. “Brands and retailers need to ensure that their price points, advertising, marketing and user-generated content (UGC) is focused and ready to attract, inspire, and convert customers while they’re in the mood to shop.”

The findings are based on the Bazaarvoice and Influenster survey of 21,480 members of the Influenster community from May 18 to May 27.

Prime intentions

Prime Day is an annual 48-hour event highlighting discounts on specific products, exclusively for Prime members. The event offers savings on thousands of items across all product categories from both small businesses to renowned brands.

Amazon currently has 105 million members in its Prime loyalty program, according to estimates from Consumer Intelligence Research Partners (CIRP). This translates to 82 percent of United States households holding Prime memberships.

Prime Day is exclusively open to Prime members. Image credit: Amazon

Prime Day is exclusively open to Prime members. Image credit: Amazon

Although the official event begins June 21, some deals are already available and advertised on the ecommerce giant’s landing page.

According to Bazaarvoice’s new survey, one in two consumers said they are planning to shop at Amazon. One in five respondents said that this will be the first time participating in Prime Day.

“Scarcity is a primal urge for consumers — fear of missing out drives emotional purchasing behaviors,” said Matthew McNerney, creative director of experience at Landor & Fitch, New York. “Amazon has capitalized on this psychological trigger through intelligent cues: countdown clocks, real-time inventory metrics, wait list sign-up, etc.

“Amazon is able to fabricate the tension of Black Friday on a random calendar day; it’s quite the feat,” he said. “The other factor to consider is that Amazon updates their prices every 10 minutes, totaling 250 million price changes daily, with Prime Day providing the illusion that this is ‘the best price ever’, but sometimes it’s just the standard MSRP (manufacturer suggested retail price).”

When asked how much a product needs to be discounted to consider purchasing, 58 percent of respondents said that it depends on the product. Twenty percent of respondents said they will be looking for a gift for a special occasion or celebration.

Ninety-four percent of respondents said they will be shopping for themselves, while 62 percent said they will be shopping for their families. Forty-three percent of respondents said they’d be shopping for their partners and 33 percent noted their intention to shop for their children.

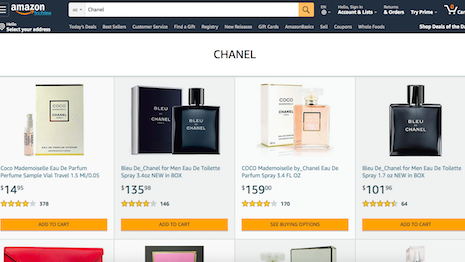

This year, beauty is the most sought out category. Image credit: Amazon

This year, beauty is the most sought out category. Image credit: Amazon

Fifty-two of respondents said that they are looking to purchase beauty products on Prime Day, followed by 47 percent of respondents stating they are not looking for anything specific but are going to see what is on sale. Forty-two percent of respondents said they planned on buying apparel that day, while 40 and 39 percent said they would purchase houseware and electronics, respectively.

Ninety-one percent of respondents said that they trust reviews on Amazon, while 9 percent said they do not. Of those who do trust the reviews on Amazon, 30 percent said they would also look at reviews on other sites but still purchase the desired products on Amazon.

“User-generated content (UGC) is especially important during this sale that will be mostly, if not exclusively, online,” Landor & Fitch’s Mr. McNerney said. “Ratings, reviews and customer photos and videos allow shoppers to more easily envision themselves using or wearing a product that they’re not able to see in-person, and gives them the confidence to purchase it sight unseen, because they trust other consumers more than they trust brands.”

Through their online and in-store presence, brands should continue to look for ways to produce user-generated content, as consumers value the confidence and transparency UGC offers.

Returns can eat into retailers’ bottom lines, but providing enough context and information through features such as UGC can help consumers anticipate what to expect (see story).

Other retailers following suit

With Amazon holding such a well-publicized event, other retailers and brands are urged to also have discounted-deal offerings prepared for consumers.

The consensus from experts is that luxury retailers should not shy away from occasional sales events. For instance, department store Nordstrom is a high-end retailer whose annual sales event precedes Amazon by decades.

Dating back to the 1960s, the Anniversary Sale is the retailer's biggest shopping event of the year. Every summer, the Anniversary Sale offers discounts on fall arrivals. Nordstrom sees the sale as an opportunity to engage shoppers across a variety of price points and styles (see story).

About in four respondents, 24 percent, from Bazaarvoice’s new survey said they are planning to shop at a combination of retailers on Prime Day. Twenty-three percent said they will decide the day of where they will be shopping.

When asked whether they would want to buy from a particular store or where the discount is greatest, 64 percent said they will shop wherever the discount is the greatest.

“I think Amazon’s Prime Day has certainly pushed other retailers to offer similar prices, sometimes during the exact same promotional dates,” said Landor & Fitch’s Mr. McNerney. “Target has Deal Days, Walmart has its Big Save Event and even Alibaba created Singles Day.

“But Amazon is pulling almost 45 percent of all ecommerce spending across the internet,” he said. “It’s really hard to compete with that.”